Latest data from China's National Bureau of Statistics show that while surplus rose to record in Renminbi terms and highest since February in Dollar terms, it came in the back of significant weakness in imports. Weak imports from China exposes many economies in Asia to greater economic uncertainty.

- Latest data reveals that Chinese imports slowed down by -17.7% in September from a year ago, while exports declined by -1.1% for the same period. It has pushed trade surplus to $60.34 billion, highest since February.

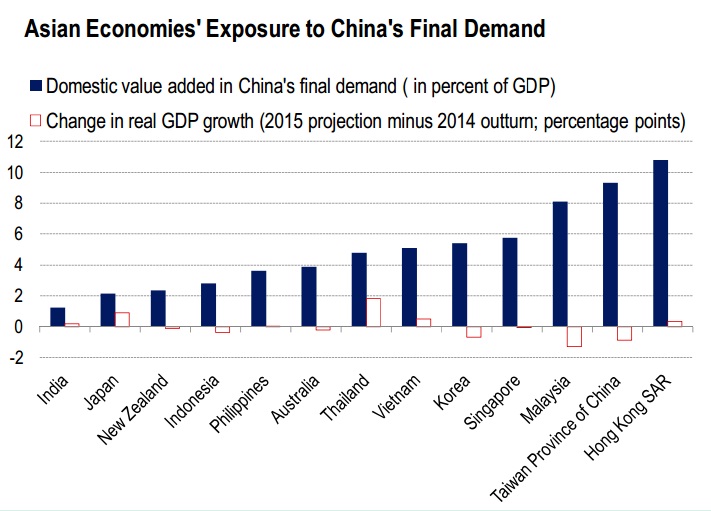

The figure from IMF shows that many economies in Asia have significant exposure to China, in terms of exports and with China's imports drying down there could be greater slowdown across emerging Asia.

Countries like Hong Kong, Taiwan, Malaysia have very high exposure followed by Singapore, South Korea, Vietnam, and Thailand, while countries like India has much smaller exposure in terms of Chinese imports.

While some market participants might cheer this record Renminbi surplus, things doesn't seem to be that bright with high exposure to Chinese economy.

Asian currencies, along with commodity currencies like Aussie, Kiwi have taken hit over the release.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate