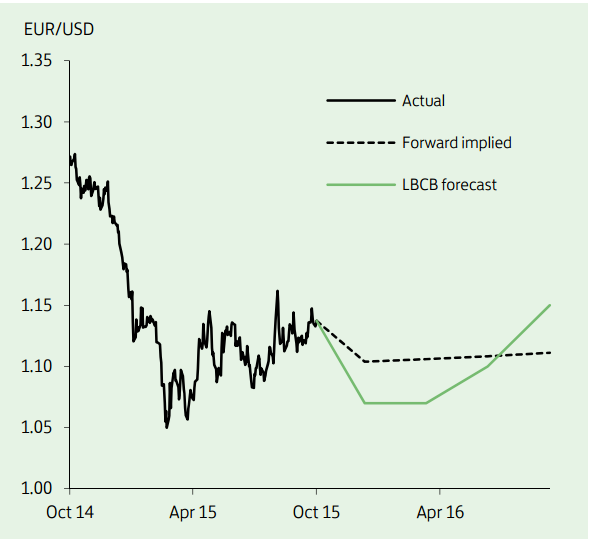

EUR/USD has moved closer to the top of its six-month 1.0458-1.1714 range over the past month due to broadly weaker-than-expected US data. A shortterm break above the August high of 1.17, however, looks unlikely, as safehaven flows fade alongside fears of a hard landing in China. Instead, the euro is expected to resume its descent, given the potential for more ECB quantitative easing (QE) and/or a US rate hike by year end. Although weaker US data have raised question marks over the latter, a negative euro area CPI outturn in September has increased the probability of the former.

That said, any downside for the euro is likely to be short-lived, in keeping with the reaction to the ECB's first QE announcement in January. The single currency should benefit from (i) the region's relative growth potential; (ii) its strong current account position; (iii) the relative weakness of euro area inflation; and (iv) the potential for some further fading of euro risk premia. Amid only a modest rise in US policy rates, EUR/USD is expected to rise to 1.17 by end-2016.

EUR/USD Outlook

Wednesday, October 21, 2015 8:56 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022