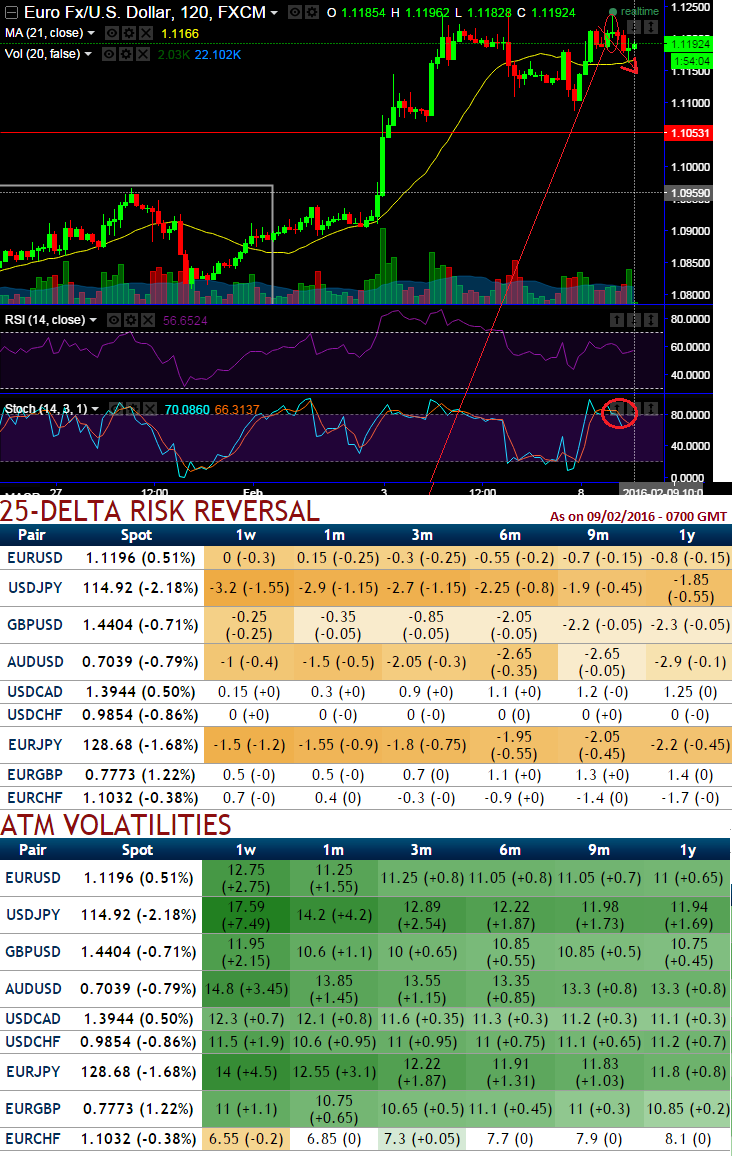

As we saw in our recent risk reversal computation of EURUSD, we may see little upside movements but those rallies may lose momentum and holds stronger for next 1 month or so, certainly not in a long run.

Please be noted that the delta risk reversal numbers are getting higher positive values but losing OTC volumes (thereby flashing at -0.3 for 1 week expiries).

Gambles on implied volatility ahead for euro-dollar exchange rates surged to a 2-month high of 11 percent on Tuesday as traders put more money on the dollar, flipping most derivatives pricing in favour of a weaker euro over the next few months.

Driven by broad market worries over European banks which have weakened the euro, one-month implied volatility jumped to a high of 11.012 in morning trade in London trading sessions, up from an almost 1-year low of 8.3% hit on Feb. 2.

As there is contraction between historic and implied volatility, the volatility smiles most frequently show that traders are not willing to pay higher implied volatility prices, as a result, the strike price grows aggressively out of the money.

You can even see these effects already in intraday charts, the minor threats of price corrections are popping up. A sharp shooting star candlestick pattern has evidenced the dips from highs of 1.1237 to today's lows 1.1162 while leading momentum indicators signal further weakness.

Hence, eyeing on the risk reversal arrangements in OTC FX markets, we reckon the recent bull rallies are losing the momentum.

Thus, many of the analysts must be waiting anxiously to hear what Fed Chair Yellen has to say tomorrow in her testimony. The flattening trend in the US 2y10y has now extended to 89bp (EU 2/10y IRS 75bp). EU 5y5y forwards have dropped to 1.47%, a new low.

EUR/USD 1M IVs rise to highest since early December at around 11 pct, risk reversal favors dollar again

Tuesday, February 9, 2016 1:05 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary