Last month of 2015, the ECB has not delivered what streets expected (not a full depo cut we had in mind i.e. -10bps versus forecasts of -20bps) but the extended QE programme we were looking for (now due to run at least until March 2017).

Slow pace of easing: The ECB has been firm for a programme of reinvestment as existing holdings mature, while many expected the expansion pace of asset purchases.

Although Draghi claims the reinvestment will add EUR 680bn to the ECB's balance sheet by 2019, it is perceived that he disappointed to a market accustomed to, (1) upfront easing and (2) Draghi over-delivering.

It is clear he had no consensus to be much more aggressive, even though promises by Draghi that further monetary stimulus could be underway, many analysts are skeptical on central bank's sizable additions to its €1.46 tn asset-purchase programme in 2016.

There were rumors of a marginal of nonconformity by eidmann/Lautenschlaeger as well as Knot/Hansson/ Rimsevics though note Weidmann and Lautenschlaeger (the two German members) are also said to have opposed the original QE announcement in Jan.

Draghi himself says "it may take years" before the EZ returns to pre-crisis unemployment rates, but "as we have seen in the UK and US, event at that point... there may still be a substantial time lag before a tight labor market translates into higher wages."

Conversely, the first Fed rate hike is finally behind us. Many were calling for a "dovish hike" but relative to already very dovish expectations, this was nothing of that sort.

FOMC members' economic projections still imply four more hikes next year, well ahead of what the market is priced for. For many, the 25% rally in DXY to its Dec peak is likely to mark the exhaustion of the trend.

However, these speculations have left the forecasts unchanged in this month (EUR/USD 1.03 end-Q1 and parity by end-Q2).

Hence, EURO could be boosted temporarily by risk aversion in its role as risk off proxy or more sustainably by signs of inflationary pressures.

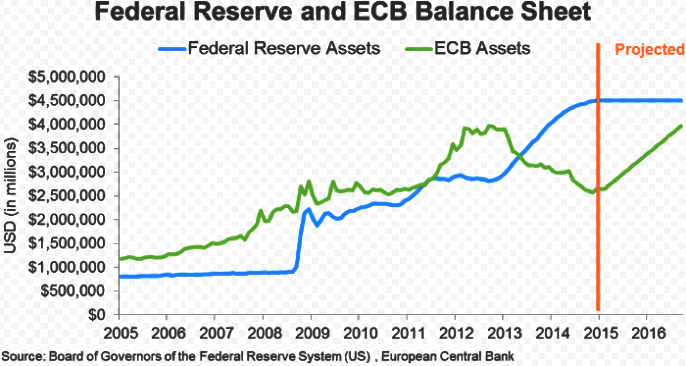

ECB’s B/S numbers despite German members’ denials to prop-up EURO while Fed’s hiking in 2016 likely to trim EUR/USD

Monday, January 4, 2016 11:41 AM UTC

Editor's Picks

- Market Data

Most Popular

5

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell