The only dollar potency that is expected during Q1 2016 was to come against the commodity currencies given excess supply in oil, metals and bulk commodities; and versus emerging markets currencies where imbalances were greater (subtrend growth, current account deficits, commodity exposure high).

Thus the G3 currencies (EUR, JPY) would diverge from EM and commodity FX, and meaningless but widely followed index like DXY (lower in 2016) would diverge from a proper trade-weighted one like USD nominal effective index (slightly higher in 2016).

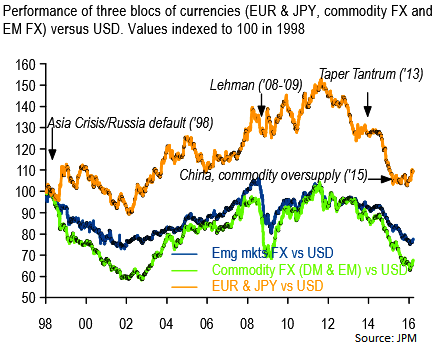

These divergences have occurred several times in the past when either idiosyncratic issues were so distinct across regions:

Asian Crisis/Russian default in 1998;

China’s slowdown plus commodity oversupply in 2015; or

When systemic shocks favoured funding currencies over high-yielders (Lehman in 2008-09, Taper Tantrum in 2013)

The above chart evidences these episodes in dollar pricing.

The bigger challenge for now is whether the dollar has already seen its cycle highs on an index basis (a proper trade weighted one, rather than the meaningless DXY)or by pair, either because the FOMC may never hike again, or because the Fed may hike too slowly to lift real interest rates; or because other drivers of this bull market (the EM slowdown, commodity oversupply) might reverse around the time the Fed hikes.

Our view in late 2015 when we issued the year-ahead outlooks was that the dollar had already topped versus the yen because every yen-negative force of the Abenomics era was ending:

Japan regained its current account surplus, GPIF’s portfolio reallocation was near-complete and BoJ easing had hit diminishing returns.

Hence the original end-2016 target of 110, which we revise today to 103.

The view on the euro was that it would respect the same range in 2016 as in 2015 (roughly 1.05 to 1.15) because so much Fed/ECB divergence was already discounted.

We estimate the currency projection to end 2016 closer to the high end of the range (1.15 target) given,

Europe's record current account surplus,

the diminishing returns to ECB QE,

the possibility of another Bund VaR shock, and

the risk of a limited Fed tightening cycle.

Hence, the projection is being untouched following recent Fed's decision as the year-end target always assumed a hesitant Fed.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings