For ETHUSD (at Coinbase), Year-2019 has shown a resounding consolidation phase after bearish rout seen in 2018.

Technically, the stern bullish engulfing candle takes-off rallies about 340% in this year so far, but shooting star countered with 88.6% Fibonacci retracements, the current trend is restrained below 7 & 21-EMAs.

Shooting star is traced out at 290.07 levels (on weekly chart), to counter this vigorous rally and hampers intermediate uptrend. Consequently, the bearish pattern nudge price back below EMAs.

The intermediate uptrend has been restrained below 7 & 21-EMAs. If bulls manage to break out these levels, we could foresee more upside traction up to 255 levels by the end of H1’2020, or even up to 360 levels. Hence, the recent price dips upon shooting star are perceived as the better entry level for fresh long build-ups for the long-term investors.

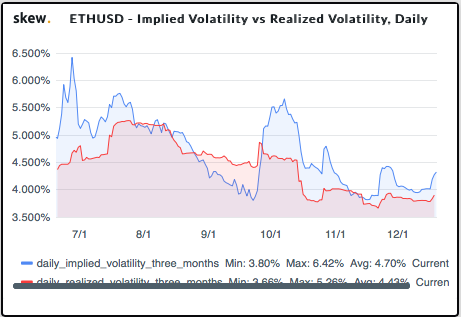

ETH RVs, as you could observe from the above chart, has been chasing downwards from the last 6 months or so, but for now, reversed and going upwards. Also be noted that the downward shift of the underlying price which is in sync with the Vols curves. But for those who are sceptical and argue about the further downtrend continuation on account of the correlation with the IV and RV cuvres, because it seemed tide in IV curve in the month of October and in mid-November but the price failed to bounce.

But the most importantly, one needs to consciously factor-in the constructive underlying developments that are taking place in the recent past in the price of ether.

While the entire cryptocurrency industry is struggling, the ethereum ecosystem continues to expand. Ethereum 2.0 is structured differently from ETH 1.0, in that it focuses on DApps existing as unique shards under the umbrella of Ethereum. Many DeFi Apps are building on ethereum and the exciting new DeFi ventures are grabbing headlines every week, from decentralized VPN providers to blockchain infrastructure projects to payment providers.

Precisely, as the DeFi movement is on the verge of emerging, today’s total crypto market cap of $195B is over $150B shy of the assets managed.

Fundamentally, we see some constructive commentaries to drive bullish ETH, while CME announced Bitcoin Options, and get to see Ethereum Futures in 2020.

On the other hand, the CFTC (Commodity Futures Trading Commission) Chair has termed Ether (ETH) as a commodity and hints the room for a plethora of newly regulated derivatives products on platforms like the CBOE.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data