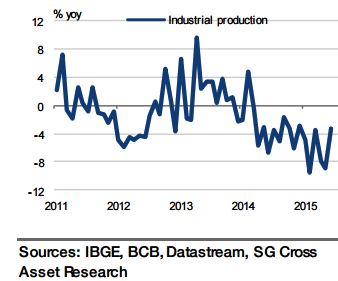

Brazil's industrial production fell 6.7% yoy in Q2, after falling 5.9% yoy in Q1 ( down 2.4% qoq). Given the shape of domestic and external demand, nearly the same pace of decline is expected in IP in H2. The one factor that could lead to some upside surprises on IP and exports going forward is BRL depreciation.

"However, at present, BRL depreciation seems to have a very minor impact on external demand given the low price elasticity of Brazilian exports and considering that global demand remains depressed. Following the trade numbers, IP is expected to contract 5.9% yoy (-0.4% mom) in July implying the economy started on a bad footing in Q3", says Societe Generale.

Industrial production declined by 3.2% in 2014 after modest growth of 2.1% in 2013. This was mainly the result of the manufacturing sector's lack of competitiveness, weaker growth in trading partner countries and, more recently, declining domestic demand.

"While the BRL has depreciated heavily over the past few quarters, further significant depreciation could be needed to improve export competitiveness in the medium term and revive Brazilian manufacturing. Structural reforms, as and when implemented, to revive investment in manufacturing will likely have limited success in the medium term, particularly given the domestic and external demand environment", added Societe Generale.

Decline in Brazil's IP likely continued in Q3

Tuesday, September 1, 2015 4:16 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed