Amid the massive price plunge of pioneer cryptocurrency (Bitcoin) in the recent past, the hedge funds’ prime objective is to outperform the market, they would usually be aggressive in risk appetite and expect to be prudent enough to generate high yields irrespective of the trend of the market.

The people generally tend to think that the bearish rout would have caused the gloomy returns for crypto hedge funds business, contrary to this, a report suggests institutional investors inclination towards the gamut of crypto-hedge funds.

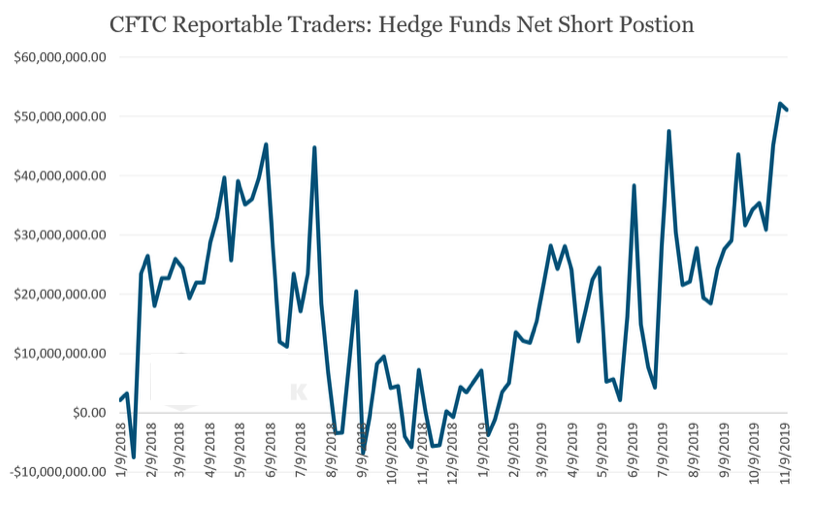

Hedge funds appear to be overwhelmingly short during course of mid-November compared to the sell-side, asset managers, and other groups.

Especialy, net short positioning (Short OI - Long OI) among hedge funds that trade the CME bitcoin product was at an all-time high over the last two weeks of COT report prints.

While the pair (BTCUSD) is down 7.69% at time of publishing, breaking below key support at $7,000 to a six-month low of $6,768.

These crypto hedge funds were able to double their Assets under Management (AuM) in 2018, comparatively, with the median crypto hedge fund AuM growing from $2.1 million in January 2018 to $4.3 million at the end of the Q1 of 2019, according to the report.

We quickly run you through the important take-aways of this report:

Size of the Market and AuM:

- We estimate that there are 150 active crypto hedge funds collectively managing US$1bn AuM (excluding crypto index funds and crypto venture capital funds)

- Over 60% of these funds have less than US$10m in AuM with fewer than 10% managing over US$50m

- The average crypto hedge fund AuM as of Q1 2019 is US$21.9 million

- The median AuM of funds as of Q1 2019 (US$4.3m) is 3X that of the median AuM at fund launch (US$1.2m - January 2018), which indicates that funds have been relatively successful at fundraising despite difficult market conditions.

But for now, the block reported, a data shows them that the net positioning of CME bitcoin futures; funds could still be exposed to the underlying spot on the long side and using bitcoin futures to hedge out risk.

While at last check, BTC was trading lower side by -19.55% from $8,806 on November 12 at around $7,085. If those funds squared-off their position, that would have left them with some returns from the price slump.

But the short position, according to them, has been significant given sentiment throughout the second quarter of 2019.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty