Crypto-derivatives space has witnessed various developments in the recent past.

The Commodity Futures Trading Commission (CFTC) has approved crypto firm LedgerX to offer physically settled bitcoin futures contracts.

While Bakkt is scheduled for its test of BTC futures contracts, Bakkt’s own futures contracts have been self-certified, the firm is waiting for the New York Department of Financial Services to license its warehouse) and they are likely to lure institutional inflow. The new cryptocurrency start-up, ‘Bakkt’ established by the Intercontinental Exchange (ICE), was all set to launch bitcoin futures contracts with physically delivery facilities.

As Bitcoin extends its bullish streaks to establish fresh 2019-highs, as a result, the trading volume on the BitMEX exchange has also continued to register record all-time highs. BitMEX has managed to clear a total volume of around $10.795 billion – all from the Bitcoin derivatives market.

In addition, they have also succeeded in recording US$1 Billion open interest on the Bitcoin perpetual swap contract.

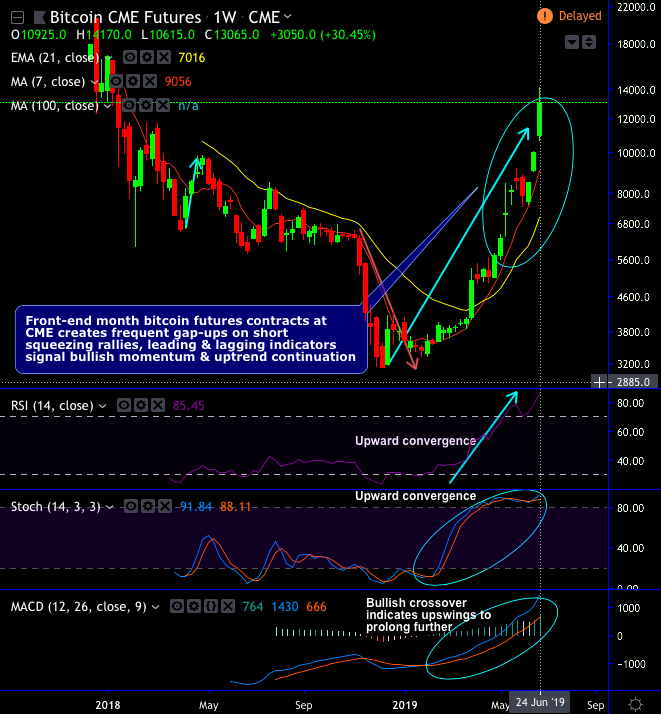

Amid all these developments, the bullish steaks of the underlying security bitcoin trading have been commendable, BTCUSD surged to $13.8k mark on Bitfinex exchange (which is mammoth returns of 313 in percentage terms that too within a span of 6 months or so), currently, trading at $12.7k (1stchart).

We also witnessed the short squeeze activities in the Bitcoin Futures markets due to the recent price volatility and the sudden spike in price. This is majorly due to shorts are forced to square-off their positions (incurring a loss) as the underlying price increase.

Now, take a look at the above technical charts of CME BTC futures of front-end month contracts, having risen so sharply and swiftly, one can easily make out that the pioneer cryptocurrency has created considerable gaps quite often if you plot the technical charts of CME’s Bitcoin Futures contracts of near month deliveries (2ndchart). It is nothing new but owing to the short squeeze trading activities.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 90 levels (which is highly bullish), USD is at 30 (mildly bullish) while articulating (at 06:06 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation