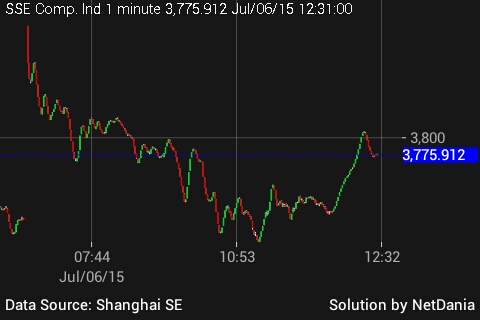

Chinese authorities are throwing in almost everything to prevent a stock market meltdown, which at its peak was up more than 150% in 12 months. The rally has soured since June and the stock market is down almost 28% in last 3 weeks.

Today the stock fell by another 1.3%, in spite of so many measures taken.

Government and regulators seem to have taken the stance of doing whatever it takes to prevent a full scale rout, however all the measures taken so far remains not only short sighted but dangerously risky.

- People's bank of China (PBOC) has provided rate cut and targeted reserve ratio cut, which has failed to prevent the downfall so far. Monetary policy actions usually works with a time lag, but the rapidity and the time of the action revealed the state of panic among government officials.

- 21 brokers in China have summed up Yuan 120 billion fund, which would invest in Blue chip stocks. Moreover PBOC would provide liquidity to China securities Finance (CSF) which would then lend to the brokers' fund. CSF makes margin financing available to brokers. CSF's capital would also be quadrupled to 100 billion Yuan. With 5 day average of realized volatility more than 7% and daily turnover of more than Yuan 2 trillion, the fund is unlikely to last even a day in this market. Moreover it will exacerbate the rout in small caps as investors push money towards blue chip.

- Chinese securities regulatory Commission (CSRC) has moved swiftly to ban short selling. However such a rout is not due to short sellers but liquidation by long term holders. Moreover history shows, short selling ban doesn't work and stocks have historically fallen more after the ban.

- Country's sovereign fund and pension funds are going to invest in the market. It is not a prudent strategy to push country's wealth and people's pension in such volatile stock market in a bid to prevent the crash.

- CSRC have eased the margin financing rules, which means one can bet almost anything on the stock market. In a market where margin financing is already at record, pushing for more is a very risky strategy. Moreover, easing margin rules which allows investor to bet even house and households to stock market is sure to cost heavy if collapse continues.

- Chinese authorities and companies have suspended trading on 745 stocks. Monday alone 200 companies suspended trading. This is not a very fine choice to prevent slide. As of now 26% of the listed firms are not tradable, which is $1.4 trillion worth. These practices reduce confidence of the longer term stock investors.

Several other measures such as easing rules for foreign investors were also taken up by the authorities.

What Chinese authorities should really do is to get economic fundamentals back on track, rather than throwing everything to fight the stock bear.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary