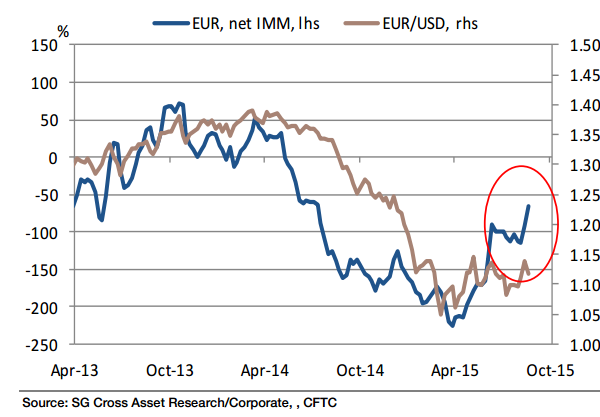

EUR/USD escaped the narrow trading range last month, scaling a 1.1714 high on 24 August. Short IMM positions have been cut to the lowest level in over a year. The biggest EUR gains have come against the commodity currencies, but a Fed rate hike should trigger EUR/USD profit taking. Support 1.10. The EUR attracted strong support after the devaluation of the CNY and the selloff in equity markets. In trade weighted terms, the euro is up over 3% over the past month.

The current account surplus (2.3% of GDP) is a stabilising factor. The ECB revised down its inflation forecasts at the 3 September meeting to reflect lower oil prices, and hinted at possible expansion of QE. It raised the share limit of bond purchases from 25% to 33%. The 2015 inflation forecast was lowered from 0.3% to 0.1%, 2016 CPI was cut from 1.5% to 1.1% and 2017 CPI was lowered from 2.0% to 1.8%

China and risk aversion lift Euro

Friday, September 4, 2015 12:27 AM UTC

Editor's Picks

- Market Data

Most Popular