Japan's core CPI prints worse than forecasted, actual -0.5% versus forecasts at -0.4%.

As per yesterday closing the greenback had appreciated by more than 3.6% against the G10 currencies on a trade weighted basis since the beginning of the month and by 3.3% against the currencies of all US trade partners (based on our extrapolative calculation of the trade-weighted Fed USD indices).

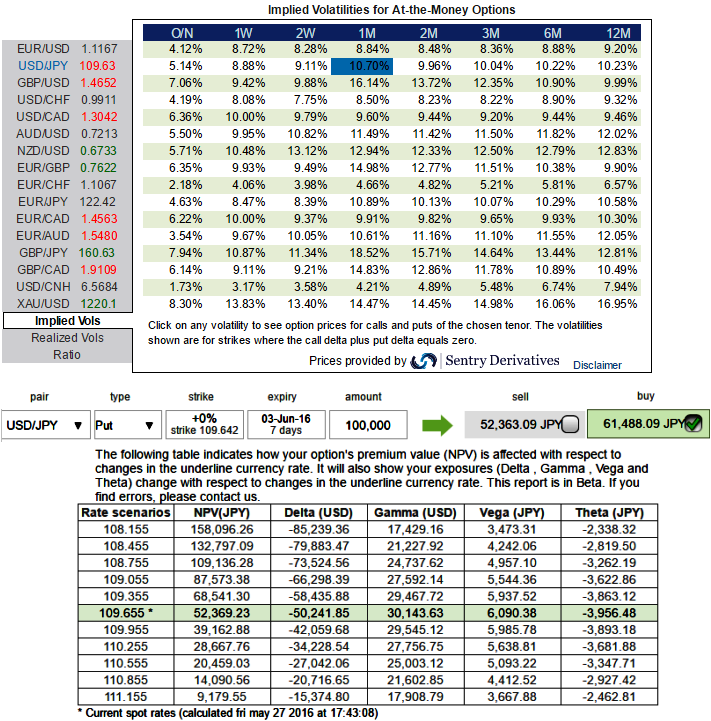

The implied volatility of ATM contracts for near month expiries of this the pair is at around 10.70% and for 1w expiry at 8.88%. , delta risk reversal for the pair is still displays higher negative values among entire G10 currency space for all expiries, so we believe any abrupt short term upswings are the best advantage for bears and may be utilized for shorts in hedging strategies so as to reduce the hedging costs. (Compare delta risk reversal with last week).

The premiums of ATM puts of USDJPY are trading above 17.4% at JPY for lot size 100,000 units. Thereby, we could see the disparity between IVs and option pricing.

Hence, those who compare this difference in options premium with implied volatility, and think the hedging cost for downside risks would not be economical as result of deploying ATM instruments.

Contemplating that factor we cannot afford to remain stuck in this riddle without hedging, so what could be the alternative, in forwards markets at least..?

Subsequently, here comes the "arbitrage strategy" in which options trading that can be performed for a riskless profit as USDJPY ATM put options are overpriced relative to the underlying exchange rate of USDJPY.

To perform this conversion, at USDJPY spot ref 109.639,

the hedger shorts the underlying spot FX and offset it with an equivalent synthetic short put (i.e. short spot FX + long ATM call) position.

Profit is locked in immediately when the conversion is done, the profit would be the difference between the short price of spot FX and price of forward price and premium paid.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty