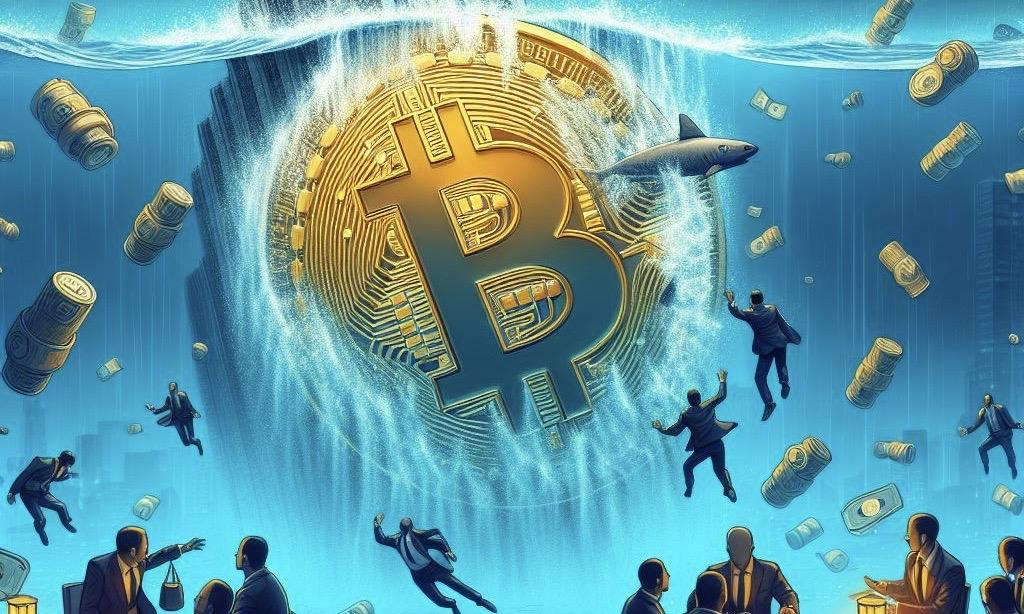

Bitcoin's recent 7% drop triggered a significant $256 million liquidation of long positions, yet analysts remain unfazed, attributing the fall to normal market cycles amidst geopolitical tensions.

Analysts Downplay $256M Bitcoin Liquidation as Market Adjusts to Geopolitical Strains

A recent Cointelegraph report stated that Bitcoin's price drop of more than 7% in the previous 24 hours has resulted in $256 million in losses for traders with long positions. However, analysts feel it is nothing out of the usual amid rising geopolitical tensions in the Middle East.

“So far, this is a normal drop. In fact, we’ve had several 20-22% drops this cycle,” Benjamin Cowan stated in an April 13 post on X.

“Chaos is good for Bitcoin,” MicroStrategy CEO Michael Saylor declared in an April 13 post on X.

Meanwhile, pseudonymous crypto trader Rekt Capital expects Bitcoin's price will resume its "uptrend," but only after enduring some short-term pain:

“Bitcoin will retrace deep enough to convince you that the Bull Market is over,” Rekt explained.

On April 13, Bitcoin's price fell to $60,919 before regaining support at $62,060. According to CoinMarketCap, its current price is $63,858.

Over the last 24 hours, $319.15 million has been liquidated from leveraged Bitcoin positions due to the abrupt price drop.

Massive Liquidations and High Demand Highlight Bitcoin’s Volatile Market Dynamics

According to CoinGlass data, this includes $256.58 million in long positions and $62.58 million in short positions. Traders appear to be ready for further losses. If Bitcoin's price reverted to $67,000 from just 24 hours ago, short positions worth $1.05 billion would be liquidated.

Although the whole cryptocurrency market suffered, 253,554 traders liquidated $945.9 million in the last 24 hours. The Crypto Fear and Greed Index, a metric used to track cryptocurrency market sentiment, is currently at 72, a tiny decline from last week's excessive greed score of 78.

The worldwide cryptocurrency market capitalization has also dropped by 8%, reaching $2.23 trillion. Meanwhile, Cointelegraph noted that the demand from Bitcoin whales has never been higher.

According to data published by crypto analytic firm CryptoQuant, demand from "permanent holders" has surpassed the market supply of new Bitcoin for the first time.

This shows that the amount of new Bitcoin created by mining is insufficient to match the demand of crypto investors, and the scarcity will only increase following the Bitcoin's halving.

Photo: Microsoft Bing

Lawyer Accuses DOJ of 'Obvious Disdain for Privacy' in Tornado Cash Case

Lawyer Accuses DOJ of 'Obvious Disdain for Privacy' in Tornado Cash Case  Traders Forecast Best Altseason Since 2017 as Bitcoin Momentum Cools

Traders Forecast Best Altseason Since 2017 as Bitcoin Momentum Cools  Adidas and Stepn Unveil NFT Sneakers in Trailblazing Web3 Partnership

Adidas and Stepn Unveil NFT Sneakers in Trailblazing Web3 Partnership  Shiba Inu Faces New Correction, Dips Below Key Support Levels

Shiba Inu Faces New Correction, Dips Below Key Support Levels  Samsung's Lee Jae-Yong Forges Strategic AI Chip Production Alliance With ZEISS

Samsung's Lee Jae-Yong Forges Strategic AI Chip Production Alliance With ZEISS  China Beat South Korea in OLED Panel Shipments for Small Gadgets

China Beat South Korea in OLED Panel Shipments for Small Gadgets  Shiba Inu Tops Robinhood, 300M Dogecoin Moves As Market Eyes Breakout

Shiba Inu Tops Robinhood, 300M Dogecoin Moves As Market Eyes Breakout  Mainland China Investors Blocked from Accessing New Hong Kong Bitcoin ETFs

Mainland China Investors Blocked from Accessing New Hong Kong Bitcoin ETFs  Musk Engages China: Baidu’s Data Deal and High-Stakes Hotel Meet with CATL

Musk Engages China: Baidu’s Data Deal and High-Stakes Hotel Meet with CATL  MetaComp and Harvest Global Launch Innovative Bitcoin Spot ETFs in Singapore

MetaComp and Harvest Global Launch Innovative Bitcoin Spot ETFs in Singapore  SHIB Price Climbs as Shibarium Upgrade Sparks Optimism Among Investors

SHIB Price Climbs as Shibarium Upgrade Sparks Optimism Among Investors  Tesla Clears Regulatory Hurdles for FSD Launch in China with Baidu's Help

Tesla Clears Regulatory Hurdles for FSD Launch in China with Baidu's Help  Shiba Inu Issues Alert: TREAT Token Scams Surge Amid Blockchain Upgrades

Shiba Inu Issues Alert: TREAT Token Scams Surge Amid Blockchain Upgrades  Elon Musk in Beijing to Propel Tesla's Self-Driving Tech in China

Elon Musk in Beijing to Propel Tesla's Self-Driving Tech in China  Australia Set to Unveil Spot Bitcoin ETFs, $4 Billion Inflows Projected

Australia Set to Unveil Spot Bitcoin ETFs, $4 Billion Inflows Projected  Tesla Debuts Enhanced Autopilot in China for Just $98 Monthly

Tesla Debuts Enhanced Autopilot in China for Just $98 Monthly  MicroStrategy Stock Skyrockets 461.7% Despite Bitcoin Market Turmoil

MicroStrategy Stock Skyrockets 461.7% Despite Bitcoin Market Turmoil